XRP Robot Guide: How to Build Your Own XRP Trading Bot

1. What Is an XRP Robot?

XRP Robot, also known as an XRP trading bot, is a type of software designed to automate XRP cryptocurrency trading. These bots use predefined strategies, technical indicators, and real-time data to make buy or sell decisions on your behalf, reducing the need for manual intervention.

🔹 What Makes an XRP Bot Different from Manual Trading?

- ✅ Executes trades 24/7 without fatigue

- ✅ Eliminates emotional decision-making

- ✅ Responds instantly to market signals

- ✅ Can be backtested and optimized

Compared to human traders, automated XRP bots can handle rapid market changes better, especially in volatile environments. They are essential tools for day traders, scalpers, and even long-term investors using grid or DCA strategies.

🔹 Different Types of XRP Robots

There are several types of XRP bots available, depending on complexity and strategy:

- Rule-based XRP bots: Operate using fixed conditions (e.g., RSI < 30 → Buy).

- Signal-based XRP bots: React to signals from trading platforms or telegram groups.

- AI-powered XRP bots: Use machine learning for pattern recognition and predictive trading.

- Arbitrage XRP bots: Profit from price differences across exchanges.

🔹 Who Needs an XRP Robot?

Whether you're a beginner or experienced trader, an XRP robot can help you:

- ⚙️ Automate your trading without coding using no-code platforms

- 📉 Implement advanced strategies like grid trading or mean reversion

- 📊 Run XRP scalping bots to catch small price swings

- 🔧 Test XRP bots in sandbox mode before live deployment

In short, XRP bots are perfect for anyone looking to save time, reduce emotional errors, and improve consistency in their trading routines.

🔍 SEO Long-Tail Keywords Used in This Section:

- xrp trading bot for beginners

- what is an xrp robot

- types of xrp trading bots

- automated xrp bot features

- no-code xrp robot trading

Next: Why Build Your Own XRP Trading Robot? ⏭️

2. Why Build Your Own XRP Trading Robot?

Building your own XRP trading robot gives you complete control over your crypto trading strategy. Instead of relying on third-party bots or subscription-based platforms, you can customize the behavior, logic, and interface to suit your unique goals and risk tolerance.

🔹 Key Benefits of Building a Custom XRP Bot

- 🔧 Full customization: Code your own trading logic with conditions you trust

- 📊 Deep backtesting support: Optimize and validate performance with historical data

- 💰 Save on subscription costs: No recurring fees to paid bot providers

- 📈 Better integration: Connect to any exchange API (like Binance, KuCoin, Kraken, etc.)

If you’re trading XRP regularly, building a robot gives you an edge over manual trading by eliminating delay and emotion. Moreover, it's a great way to learn how algorithmic crypto trading works from the ground up.

🔹 Real-World Use Cases of DIY XRP Robots

- 🚀 XRP trend-following bot for capturing long breakouts

- 🔁 XRP grid trading bot for volatile sideways markets

- ⚠️ Stop-loss & DCA bot to control risk in downtrends

- 📤 Arbitrage XRP bot between exchanges

🔹 Why Beginners Should Try Building a Bot

Even if you're new to coding or crypto, building an XRP bot is an ideal entry point to:

- 👨💻 Learn basic programming (e.g., Python, JavaScript)

- 📈 Understand market data (OHLC, volume, indicators)

- 🔌 Get hands-on with exchange APIs

- 🤖 Experiment with AI models or no-code platforms

There are now platforms like 3Commas, HaasOnline, and WunderTrading that allow you to prototype bots without writing code. Later, you can scale to fully custom solutions using frameworks like ccxt or freqtrade.

🔍 SEO Long-Tail Keywords Used in This Section:

- why build your own xrp bot

- custom xrp trading robot benefits

- build xrp bot without coding

- backtesting xrp bot strategies

- diy crypto trading robot for beginners

Next: Tools & Platforms to Build Your XRP Robot 🧰

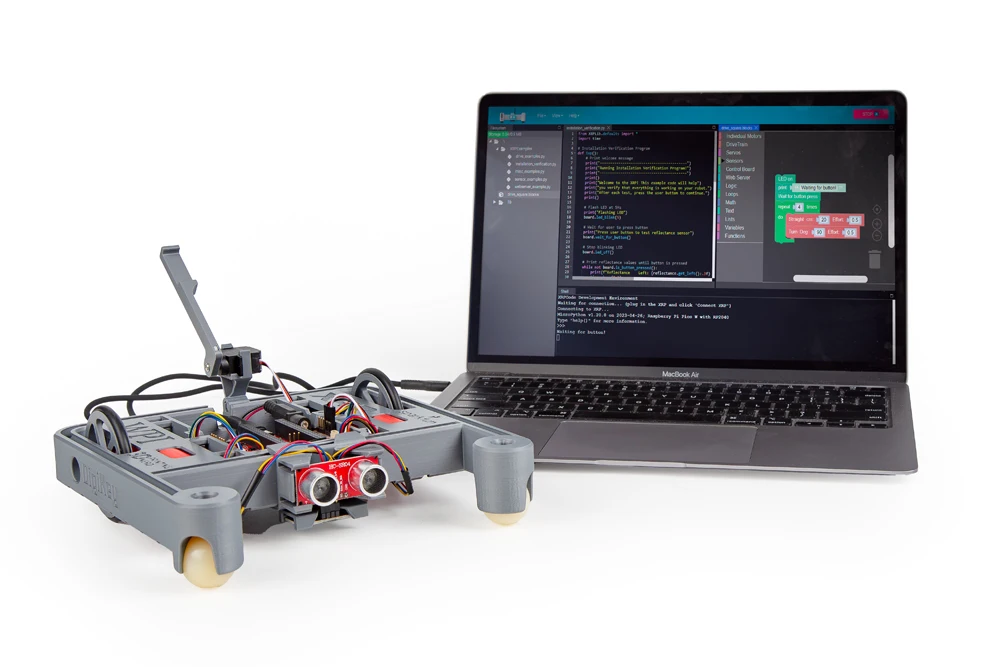

3. Tools & Platforms to Build Your XRP Robot

To build a functional and reliable XRP trading robot, you need the right set of tools and platforms. Whether you're a programmer or a no-code enthusiast, there are powerful resources available to help you automate XRP trading efficiently.

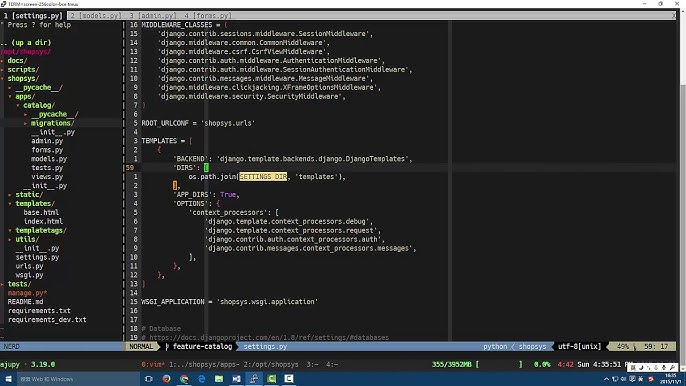

🔧 Recommended Tools for Coders

For developers and technically-inclined users, these tools are highly recommended:

- Python + CCXT – A powerful library that allows connection to exchanges like Binance, Kraken, KuCoin.

- Freqtrade – Open-source crypto trading bot with strategy backtesting and AI model integration.

- Node.js + Exchange APIs – Use raw WebSocket or REST APIs for high-frequency XRP trading.

🧰 Platforms for Non-Coders

Want to build an XRP bot without coding? These platforms offer intuitive drag-and-drop or template-based solutions:

- 3Commas – Visual bot creation, smart trading terminal, and portfolio tracking.

- WunderTrading – Copy trading + TradingView signal integration.

- Cryptohopper – Pre-built XRP bot templates, paper trading, and marketplace.

🔌 Exchange Platforms That Support XRP Trading Bots

These exchanges provide APIs and good liquidity for automating XRP trades:

| Exchange | API Support | Trading Fees | Notes |

|---|---|---|---|

| Binance | REST, WebSocket | 0.1% | Highest XRP liquidity |

| KuCoin | REST, WebSocket | 0.1% | Good for altcoin pairs |

| Bybit | REST, WebSocket | 0.1% | Supports derivatives bots |

| OKX | REST, WebSocket | 0.08% | Advanced API options |

🎓 Bonus: Simulate Your XRP Bot Before Going Live

Simulation and backtesting are crucial before risking real funds. Here are options for testing:

- Freqtrade Backtesting – Simulate historical XRP trades with performance stats

- 3Commas Paper Trading – Try XRP bots with virtual funds

- TradingView Strategy Tester – Visual test for Pine Script-based signals

Next: How an XRP Trading Robot Works ⚙️

4. How an XRP Trading Robot Works (Architecture & Workflow)

Ever wondered what happens behind the scenes of an XRP trading robot? Let’s break down the architecture and step-by-step workflow of how these bots work to automatically analyze the market, execute trades, and manage risk—all without human intervention.

⚙️ Basic Architecture of an XRP Robot

A typical XRP robot has the following core components:

- Market Data Collector – Fetches real-time XRP price, volume, and indicator data via APIs (e.g., Binance API, KuCoin API).

- Strategy Engine – Applies trading algorithms like Moving Average Crossover, RSI signals, MACD, etc.

- Signal Handler – Detects entry/exit points and sends signals to trade engine.

- Trade Execution Module – Places buy/sell orders using REST or WebSocket APIs.

- Risk Management Layer – Uses stop loss, take profit, and position sizing techniques.

- Logging & Alerts – Tracks every trade and sends real-time alerts to users.

📈 Typical XRP Trading Bot Workflow

- Step 1: Fetch XRP/USDT data from exchange API

- Step 2: Calculate indicators like RSI(14), EMA(9), MACD histogram

- Step 3: Identify buy/sell signals using defined strategies

- Step 4: Place orders instantly via API if signal triggers

- Step 5: Apply stop-loss/take-profit based on preset %

- Step 6: Log trade and update dashboard or alerts

🛠️ Signal Source: Where Do the Trading Signals Come From?

Signal generation is the heart of your XRP robot. You can generate them from:

- Technical Indicators: RSI, Bollinger Bands, Stochastic, etc.

- Custom Algorithms: Trend-following logic, breakout systems, volume-based triggers

- External Signals: Telegram signals, TradingView webhooks, AI model signals

💡 Real-World Example: Moving Average Strategy

If the 9-period EMA crosses above the 21-period EMA, the bot places a market buy order. If it crosses below, the bot sells.

🔐 Risk Management in XRP Bots

- Set Stop-Loss (e.g., -3% from entry)

- Apply Take-Profit (e.g., +5% gain)

- Limit position size (e.g., no more than 5% of total capital)

🎥 Watch: How Crypto Bots Execute Trades Automatically

Next: Choosing the Right Strategy for Your XRP Robot 📊

5. Choosing the Right Strategy for Your XRP Robot

Selecting the correct strategy is crucial for your XRP trading robot's success. Each strategy serves a different trading goal—from short-term scalping to long-term swing trading. Below, we outline popular XRP trading strategies, explain how they work, and suggest which one fits your needs.

🎯 Key Factors to Consider

- Your Risk Tolerance – Conservative, balanced, or aggressive?

- Trading Timeframe – Scalping (minutes), Day trading (hours), or Swing (days/weeks)?

- Market Conditions – Is XRP trending, ranging, or highly volatile?

📊 Popular XRP Bot Strategies

1. Scalping Strategy

Best for: High-frequency traders with fast bots and low latency

How it works: Your XRP bot opens and closes trades in a few minutes, exploiting small price movements with tight spreads.

- Indicators: VWAP, RSI(2), Bollinger Band Breakouts

- Risk: Requires precision and fast execution

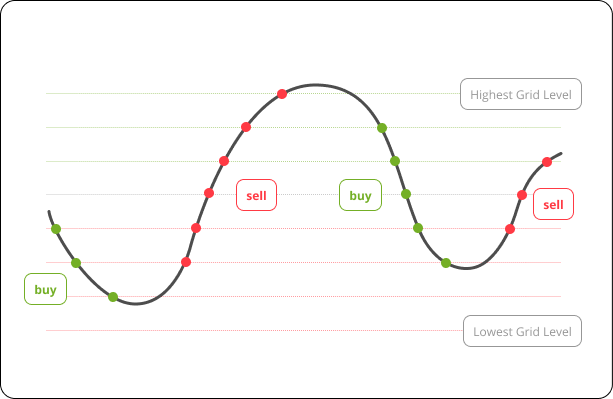

2. Grid Trading Strategy

Best for: Sideways or ranging markets

How it works: Places buy/sell limit orders at set intervals. Earns profit from market bouncing within grid range.

- Automates buys/sells without direction prediction

- Risk: Not ideal in strong up/down trends

3. Trend Following Strategy

Best for: Bull or bear trending XRP market

How it works: Uses moving average crossovers or momentum indicators to ride trends.

- Indicators: EMA(9/21), MACD, SuperTrend

- Risk: May lag in trend reversal

4. Mean Reversion Strategy

Best for: Volatile but mean-reverting XRP conditions

How it works: Buys when price dips below historical average, sells when it rebounds.

- Indicators: RSI(30/70), Bollinger Bands, Moving Averages

- Risk: Can underperform in breakout markets

🤖 Strategy Selector Tool (Coming Soon)

We're developing a visual strategy picker that helps you choose the best XRP robot logic based on your capital, risk appetite, and trading experience.

🔥 Onzuu Strategy Marketplace (Optional Integration)

If you're using the Onzuu Trading Toolkit, you can access our curated list of XRP bot strategies tested across major exchanges. Each strategy includes:

- ✅ Backtested Performance

- ✅ Ready-to-deploy JSON for API bots

- ✅ Risk Controls & TP/SL settings

Explore XRP Bot Strategies on Onzuu →

🎥 Video: Choosing the Right Bot Strategy

Next: Connecting Your XRP Bot to Real-Time Exchange API 🔌

6. Connecting Your XRP Robot to a Real-Time Exchange API

Now that your XRP robot is strategy-ready, the next step is to connect it to a cryptocurrency exchange for live trading. This enables your bot to access real-time market data, execute orders, and manage your positions securely and automatically.

🚀 Why You Need Exchange API Integration

- ⚡ Real-Time Market Data – Get live XRP price feeds, depth charts, and tick-level updates.

- 📈 Order Execution – Place market, limit, or stop-loss orders instantly via bot commands.

- 🔐 Account Management – Track balances, trade history, and open positions securely.

🔧 Step-by-Step: Connect XRP Bot to Binance API

- Login to Binance and go to your account dashboard.

- Navigate to

API Management, create a new API key, and label it XRP Bot. - Copy the API Key and Secret Key (store securely).

- In your bot configuration file or dashboard, paste your API credentials.

- Set required permissions:

- ☑ Read Market Data

- ☑ Enable Spot & Margin Trading

- ☐ Disable Withdrawals (for safety)

- Test the connection with a dry-run or simulated environment.

🔌 Connecting to Other Major Exchanges

- Coinbase Pro: OAuth2 keys & passphrase setup

- Kraken: REST API + WebSocket feeds

- KuCoin: High-throughput API with sandbox support

📦 Optional: Use Onzuu Bot Builder API

If you're using Onzuu Bot Builder, connecting to exchanges is even easier. Simply:

- Create an account at onzuu.com

- Paste your exchange API keys securely

- Choose a strategy, or import JSON strategy file

- Deploy and monitor via Onzuu Dashboard

🛡️ Security Tips for API Usage

- NEVER enable withdrawal permissions unless absolutely necessary.

- Use IP Whitelisting for API calls if supported by exchange.

- Regenerate API keys periodically and monitor usage logs.

🎥 Video Guide: How to Connect Crypto Bot to Exchange

Next: Testing Your XRP Robot in a Safe Simulation Environment 🧪

7. Testing Your XRP Robot in a Safe Simulation Environment

Before deploying your XRP trading robot into the live market, it's crucial to test your logic, timing, and safety mechanisms in a sandbox environment. This helps you avoid costly mistakes and ensures your strategy behaves as expected under real-world market conditions.

🧪 Why Simulation Testing Matters

- ✅ Risk-Free Evaluation – No real funds are used; test with virtual assets.

- 🔁 Strategy Iteration – Rapidly fine-tune parameters based on outcomes.

- 📊 Performance Metrics – Track profit/loss, drawdown, win rate, and latency.

📌 Setup Options for XRP Bot Simulation

- Backtest with Historical XRP Price Data

- Download CSV/XLS of historical XRP prices

- Feed into your bot’s backtesting engine

- Review trade logs and PnL stats

- Paper Trading with Exchange Sandbox

- Use Binance TestNet or KuCoin Sandbox

- Load test funds (e.g. 10,000 XRP virtual)

- Execute trades in real-time without risk

- SimLab from Onzuu (Recommended)

- Plug in your XRP bot code or drag-and-drop logic

- Simulate using real-time mirrored order book

- AI-powered bug detection & optimization

🛠️ Using Onzuu SimLab for Pro-Level Testing

Onzuu SimLab is a beginner-friendly but powerful simulation engine tailored for crypto bots. It lets you simulate your XRP strategy across different markets and conditions—without writing a single line of backend code.

📋 Example: Simulated XRP Bot Trade

Bot Strategy: RSI-based Buy/Sell Sim Period: Jan 2024 – Apr 2024 Profit: +18.6% Drawdown: -4.3% Win Rate: 61.7% Execution Latency: ~135ms